Taboola Acquiring Connexity, Bringing Personalized e-Commerce Recommendations To The Open Web

Posted 3 years ago by admin

Acquisition creates one of the largest e-Commerce media platforms on the open web;

Connexity clients include Walmart, Wayfair, Skechers, Macy’s, eBay and Otto

- Connexity is one of the largest e-Commerce media platforms on the open web, with over a million monthly transaction events.

- The acquisition will enable merchants to reach new clients through Taboola on the open web.

- Taboola and Connexity will be well positioned to drive growth to digital properties and help diversify their revenue mix, while also helping merchants and advertisers — all capitalizing on the significant future growth potential within the $35+ billion e-Commerce media addressable market in the US, according to eMarketer.

- Connexity drives its merchant business using contextual signals, alongside direct relationships with publishers, similar to Taboola – hence is not reliant on third party cookies.

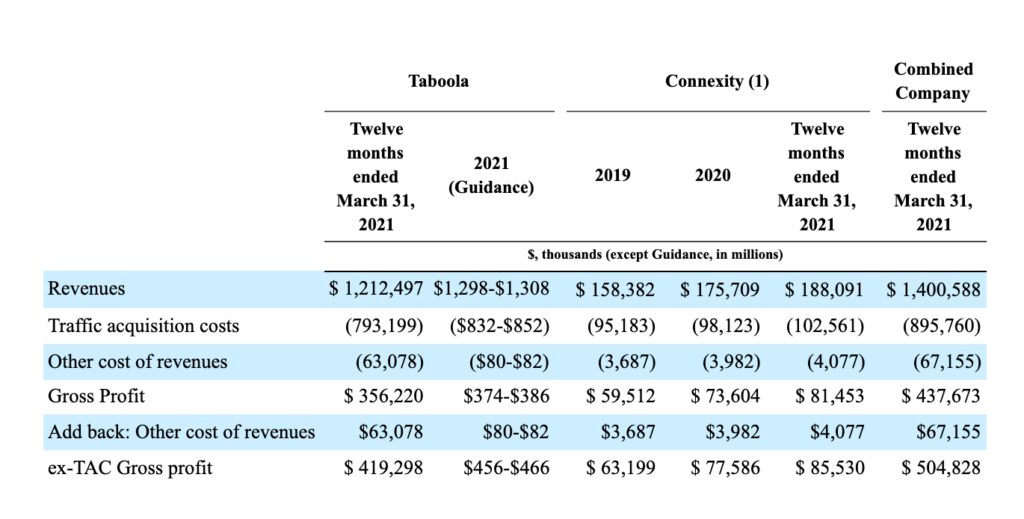

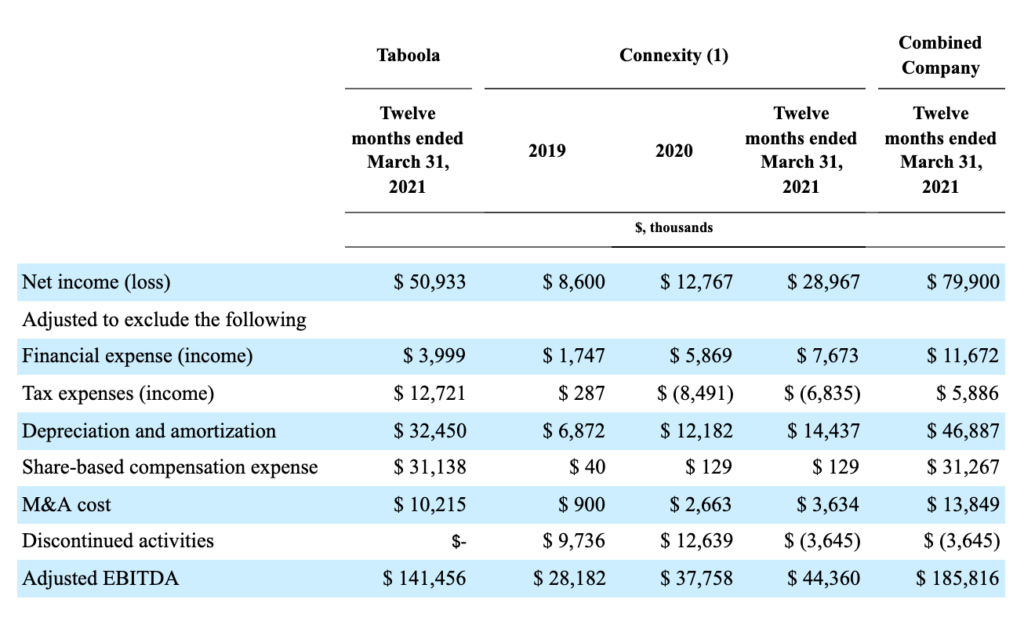

- This acquisition creates a company with ex-TAC Gross profit of over $500 million, and approximately $185 million of adjusted EBITDA over the twelve months ended March 31, 2021.

- Taboola expects to grow its stand-alone ex-TAC Gross profit in 2021 more than 20% versus 2020. When including Connexity, the pro forma growth of ex-TAC in 2021 vs 2020 is also expected to exceed 20%.

- The transaction is expected to be accretive to our anticipated profitability in the first full year following the transaction.

- The combination will mark a significant step forward towards Taboola’s open web vision by bringing a market-leading catalog of e-commerce offerings into Taboola’s “Recommend Anything and Anywhere” strategy.

- The total consideration of the transaction is approximately $800 million, consisting of cash and Taboola shares.

New York, NY, July 23, 2021 — Taboola (Nasdaq: TBLA), a global leader in powering recommendations for the open web, helping people discover things they may like, announced today that it has entered into a definitive purchase agreement to acquire Connexity from Symphony Technology Group for approximately $800 million. Connexity is one of the largest independent e-Commerce media platforms in the open web, serving over 1,600 direct merchants, and 6,000 publishers.

Connexity’s core technology powers customer acquisition for leading merchants including Walmart, Wayfair, Skechers, Macy’s, eBay and Otto. Connexity reaches more than 100 million unique shoppers per month, via relationships with premium publishers including Condé Nast, DotDash, Hearst, Vox Media, Meredith, and News Corp Australia. In addition, Connexity allows publishers to seamlessly integrate more than 750 million product offers on their websites, providing a significant revenue stream.

The acquisition of Connexity aligns with Taboola’s “Recommend Anything” growth strategy to introduce new types of recommendations and enter new segments, while leveraging its significant scale and recommendations platform to deliver even greater value to its 9,000 digital property partners, 13,000 direct advertisers and 500 million daily active users. This acquisition empowers a new type of advertiser to connect with Taboola’s massive and global audience across the open web, while providing publishers with a new and additional way to drive meaningful revenue growth, tapping into the estimated $35 billion U.S. e-Commerce media market, as well as the large global market.

Taboola’s advanced technology coupled with Connexity’s retail expertise and index of more than 750 million product offers will help introduce a new type of recommendation offering for Taboola on the open web. These recommendations will connect editorial content to product recommendations, where readers can easily buy products related to stories they are reading.

“We’re so excited to welcome the Connexity team to our Taboola family, today is a big day,” said Adam Singolda, CEO and founder, Taboola. “The rise of social commerce proves the value of commerce alongside content, and with Connexity, Taboola is primed to bring this value to the open web. e-Commerce is the future of the open web, consumers will be buying outside of Amazon, on publishers’ sites next to trusted editorial content a lot more than they are today. Amazon has millions of merchants, but merchants mainly have Amazon. That changes today. Combining Taboola and Connexity’s technologies is one step forward in creating an alternative to walled gardens.”

“Today, our vision of helping brands easily connect with customers and helping publishers grow gets supercharged with Taboola,” said Bill Glass, CEO of Connexity. “This is a shared vision for both companies, which makes this deal a natural fit and a huge win for both of our customer sets. I want to thank all of the team members as well as our loyal customers and partners who have helped Connexity pioneer its space and grow over the past 20 years.”

Today’s deal represents Taboola’s fifth acquisition and adds over 200 people to their team, bringing the number of total employees to approximately 1,600. Bill Glass, Connexity CEO, and the Connexity management team will lead the newly formed business unit at Taboola.

Connexity generated $158 million of revenue, $63 million of ex-TAC Gross profit and $28 million of Adjusted EBITDA in 2019, growing to $176 million of revenue, $78 million of ex-TAC Gross profit and $38 million of Adjusted EBITDA in 2020, driven by expansion of its merchant customer base, as well as the successful integration of Skimlinks’ market-leading commerce content technologies.

Transaction Details

Total estimated consideration for the Connexity acquisition is $800 million including purchase price and retention incentives. Taboola plans to finance the transaction with approximately $260 million from cash on hand, $300 million from committed debt financing and approximately $240 million through the issuance of ordinary shares to the seller. The exact number of ordinary shares issued will depend on the volume weighted average price of Taboola’s shares over the five business days ending three business days prior to the closing. The company expects the transaction to close in the third quarter of 2021, subject to receipt of regulatory approvals and satisfaction of customary closing conditions. Until the transaction closes, both companies will continue to operate independently.

Following becoming a publicly listed company on June 30, 2021, Taboola’s estimated fully diluted share count, as of the start of the third quarter, was approximately 256 million using the Treasury Stock Method of estimating fully diluted shares outstanding. This implies a fully diluted market capitalization of approximately $2.3 billion based on Taboola’s closing stock price of $9.00 on July 22, 2021. This market capitalization would imply dilution from this transaction to existing shareholders of approximately 10.4% at the $9.00 share price. These figures are estimates and only for illustrative purposes.

JPMorgan Chase Bank, N.A. and Credit Suisse AG acted as financial advisors to Taboola. JPMorgan Chase Bank, N.A. and Credit Suisse AG are providing committed debt financing for the transaction. Davis Polk & Wardwell LLP and Meitar Law Offices provided legal counsel to Taboola. Baird and BrightTower acted as financial advisors to Connexity. Paul Hastings LLP provided legal counsel to Connexity.

Conference Call Information

Taboola will host a conference call today, Friday, July 23nd, at 8:30am ET to discuss the transaction. The call can be accessed via webcast at https://investors.taboola.com, or by conference call by dialing (877) 312-1874, or (470) 495-9527 for international callers, and entering the conference ID 3278004.

Taboola will provide additional details about the transaction and Q2 2021 results on its Q2 2021 earnings conference call, which is planned for Wednesday, August 11th.

About Taboola

Taboola powers recommendations for the open web, helping people discover things they may like. The company’s platform, powered by artificial intelligence, is used by digital properties, including websites, devices and mobile apps, to drive monetization and user engagement. Taboola has long-term partnerships with some of the top digital properties in the world, including CNBC, NBC News, Business Insider, The Independent and El Mundo. More than 13,000 advertisers use Taboola to reach over 500 million daily active users in a brand-safe environment. The company has offices in 18 cities worldwide, including New York and Tel Aviv.

Learn more at www.taboola.com and follow @taboola on Twitter.

Non-GAAP and Combined Financial Measures; Certain Limitations on Financial Information

This release sets forth certain combined financial information for Taboola and Connexity. Connexity’s financial information reflects its historical results combined (on a simple summation basis) with the results of Skimlinks for periods prior to May 2020, when it acquired Skimlinks. Such financial information is a simple summation of results for Taboola and Connexity, and does not reflect pro forma financial results pursuant to Article 11 of Regulation S-X. Such pro forma financial results could differ materially from that set forth above.

Historical financial information for Connexity presented in this report has not been audited or reviewed by Connexity’s independent auditor. The Connexity financial information for 2019 and 2020 is derived in part from their audited financial statements and then combined with financial information for Skimlinks for all periods prior to its acquisition by Connexity in May 2020. The Skimlinks financial information contained in the combined presentation is derived from its unaudited management reports.

Following the acquisition, accounting and audit procedures could identify adjustments to Connexity and/or Skimlinks historical financial information which could be material. In addition, Skimlinks reports substantially all of its revenue on a net basis after TAC, while the Connexity legacy business reports on a gross revenue basis. We have not yet determined whether we would make any changes to their accounting policies upon acquisition; any such change could change reported revenues for Connexity and could be material Accordingly, investors should be cautious in the reliance placed on such information.

As a private company, Connexity is not subject to the public company accounting standards and Securities and Exchange Commission accounting requirements that apply to Taboola. For these reasons, the Connexity financial information contained in this report may not be directly comparable to Taboola’s financial information and may be subject to material adjustment following the acquisition. However, Management believes it is important to provide the Connexity financial information to enable Taboola shareholders and others to better understand Connexity’s business and the pending business combination.

This press release includes ex-TAC Gross Profit and Adjusted EBITDA, which are non-GAAP financial measures. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to revenues, gross profit, net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies.

The company believes non-GAAP financial measures provide useful information to management and investors regarding future financial and business trends relating to the company. The company believes that the use of these measures provides an additional tool for investors to use in evaluating operating results and trends and in comparing the company’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Non-GAAP financial measures are subject to inherent limitations because they reflect the exercise of judgments by management about which items are excluded or included in calculating them.

ex-TAC Gross Profit. The company calculates ex-TAC Gross profit as Gross Profit adjusted to include Other cost of revenues. Connexity calculates ex-TAC Gross profit as Revenues less Traffic acquisition costs with respect to its Connexity legacy business, and its net revenues for its Skimlinks business (as Skimlinks reports substantially all of its revenue on a net basis after Traffic acquisition costs).

(1) Represents Connexity results combined with results for Skimlinks (which was acquired by Connexity in May 2020) for periods prior to its acquisition date.

Adjusted EBITDA. The company calculates Adjusted EBITDA as Net income (loss) before net financial expenses, income tax provision and depreciation and amortization, further adjusted to exclude share-based compensation and other noteworthy income and expense items such as certain merger or acquisition related costs, which may vary from period-to-period. We present Adjusted EBITDA for Connexity on the same basis: Net income (loss) before net financial expenses, income tax provision and depreciation and amortization, further adjusted to exclude share-based compensation and other noteworthy income and expense items such as certain merger or acquisition related costs and Discontinued activities which may vary from period-to-period.

(1) Represents Connexity results combined with results for Skimlinks (which was acquired by Connexity in May 2020) for periods prior to its acquisition date.

Disclaimer – Forward-Looking Statements

Taboola (the “Company”) may, in this communication, make certain statements that are not historical facts and relate to analysis or other information which are based on forecasts or future or results. Examples of such forward-looking statements include, but are not limited to, statements regarding the expected timing and impact of the acquisition, future prospects, product development and business strategies and our projections for future periods. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements but are not the exclusive means for identifying such statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and there are risks that the predictions, forecasts, projections and other forward-looking statements will not be achieved. You should understand that a number of factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements, including the risks set forth under “Risk Factors” in our Registration Statement on Form F-4 and our other SEC filings. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.